When buying a burial insurance policy, I propose thinking about coverage restrictions. Burial insurance policies commonly have very low coverage amounts, so If you prefer essentially the most coverage you’ll want to check optimum coverage quantities among insurers.

Like most other states, Missouri specifies who can make the burial preparations for a deceased person. The condition lets these men and women for making the decisions, in this order:

This makes sure that beneficiaries can entry the resources necessary to cover final expenses in a very timely fashion, minimizing financial pressure during a difficult time.

If a disagreement occurs, the funeral director is permitted to utilize the Recommendations of any from the selecting get together. As an illustration, if siblings can’t arrive at a choice, the funeral director can pick which sibling’s Recommendations to execute.

After getting a clear idea of these costs, you can get started to compare diverse policies from different insurance vendors. Look for a policy that gives a adequate coverage quantity for these costs, and also fits within your finances.

For seniors seeking the best burial insurance with no waiting period, guaranteed issue lifestyle insurance is The solution.

Lower-income people today or families who are unable to manage the costs of the loved one particular’s funeral may well qualify for financial support via numerous charities, nonprofits, and/or spiritual businesses. Though the following table features samples of this kind of organizations at this time presenting assist with funerals and connected expenses, additional assets are available by making contact with the Red Cross Condolence Treatment Phone Centre toll-free at 833-492-0094.

To depart your loved ones with a clear route for covering these significant expenses, we propose investing in a specific form of life insurance named burial insurance. While you'll find numerous daily life insurance policies from which to choose, burial insurance is unique since it provides an instantaneous payout in the amount your loved ones will need to move forward with your final arrangements.

The burial insurance payout towards your beneficiaries can be spent any way they like, but it surely’s generally meant to buy funeral costs, final medical bills or little debts, and another final expenses.

You only have to shell out small quantities of income at a time for burial insurance, as well as death benefit will cover your final expenses. Occasionally, the death benefit may perhaps even be substantial enough to leave extra cash for the private use read more within your beneficiary.

Consulting with a professional on our team from Final Expense Immediate can be extremely effective in this process, assisting you navigate the complexities and make sure you take advantage of ideal choice for your scenario.

Colonial Penn provides 1 free thirty day period of coverage per annum to individuals who fork out every year for their policy, which might make the overall yearly cost considerably more economical. This generous price cut would make Colonial Penn a terrific option for budget-acutely aware seniors.

With so a variety of options offered, you might speculate with regards to the difference between burial insurance and life insurance. Despite the fact that both kinds benefit your beneficiaries if you die, they change in lots of fundamental strategies.

As we age, we want to know that our loved ones are going to be looked after after our passing. It can assist be sure that our final expenses are covered Which our loved ones hold the financial support they need to have through a hard time.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Mr. T Then & Now!

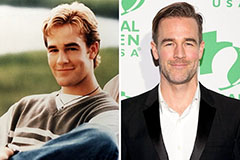

Mr. T Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!